Introduction: Financial stability is vital to a balanced and stress-free life in today’s fast-paced world. Whether saving for a significant purchase, planning for retirement, or simply managing monthly expenses, a solid financial plan is critical. By mastering both budgeting and investing, you lay the foundation for long-term financial security. This post shares ten tips to help you manage your finances and make smart investing decisions.

1. Start with a Simple Budget

Budgeting is the cornerstone of personal finance. It helps you track your money’s movement, live within your means, and achieve your savings goals. Setting up a budget is easier than you might think.

How to Build a Basic Budget:

- List your income sources, including salary, side gigs, and freelance work.

- Categorize your expenses, such as housing, utilities, groceries, and entertainment.

- Set spending limits for each category and allocate a portion for savings.

- Review your budget monthly to make adjustments as needed.

Pro Tip: Use the 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

2. Track Your Spending Consistently

Tracking your spending is essential for sticking to a budget. Many people struggle to follow a budget because they lose track of where their money goes. Fortunately, budgeting tools and apps can make this easier.

Best Budgeting Tools:

- Mint: A free app that tracks your income, expenses, and savings in one place.

- YNAB (You Need A Budget): A proactive budgeting tool to help you plan every dollar.

- Personal Capital: A tool that tracks both budgeting and investments.

Tip: Review your spending weekly to catch overspending and make adjustments.

3. Build an Emergency Fund

An emergency fund is essential for financial security. Life is unpredictable, and having a cushion prevents you from going into debt when unexpected expenses arise, such as medical bills or car repairs.

How to Build an Emergency Fund:

- Aim to save 3-6 months of living expenses.

- Automate monthly savings transfers from your checking account to a separate account.

- Start small: Even $50 a month adds up over time.

An emergency fund provides peace of mind and protects you from high-interest debt.

4. Prioritize Paying Off High-Interest Debt

If you have high-interest debt (like credit card balances), paying it down should be a top priority. High-interest debt drains your finances and limits your ability to save or invest.

Strategies for Paying Off Debt:

- Debt Snowball Method: Pay off smaller debts first, then roll those payments into larger ones.

- Debt Avalanche Method: First, pay off debts with the highest interest rates.

- Debt Consolidation: Consider consolidating multiple high-interest debts with a lower-interest loan.

Clearing high-interest debt frees more income for saving, investing, and enjoying life.

5. Automate Your Savings and Investments

Automation is a powerful way to stay on track with your financial goals. Setting up automatic transfers to your savings or investment accounts ensures consistent contributions without the hassle of remembering to do it manually.

Why Automate?

- You’re less likely to forget to save or invest.

- You can watch your money grow without constant oversight.

- The earlier and more consistently you contribute, the more time your money has to compound.

Set up automatic contributions to your retirement accounts or investment portfolio for a better financial future.

6. Start Investing: Let Your Money Work for You

Once you have a budget and an emergency fund, it’s time to invest. Investing allows your money to grow over time, helping you reach long-term goals like buying a home or retiring comfortably.

Basic Investing Tips:

- Start with Index Funds: Low-cost, diversified investments tracking market indexes like the S&P 500 are ideal for beginners.

- Use a Robo-Advisor: Automated services like Betterment or Wealthfront can help you manage your investments based on your goals and risk tolerance.

- Diversify: Spread your money across stocks, bonds, and other assets to minimize risk.

Remember, investing success depends more on time in the market than timing the market. Start small and be patient.

7. Plan for Retirement Early

It’s never too early to plan for retirement. The sooner you start, the more time your money has to grow. Consistently contribute to employer-sponsored retirement plans or individual retirement accounts to ensure a comfortable future.

Retirement Planning Tips:

- Maximize employer 401(k) matching contributions (it’s free money).

- Increase contributions as your income grows.

- Consider a Roth IRA if you’re in a lower tax bracket now than you expect to be in retirement.

Start early, even with small contributions, to let compound interest work in your favour.

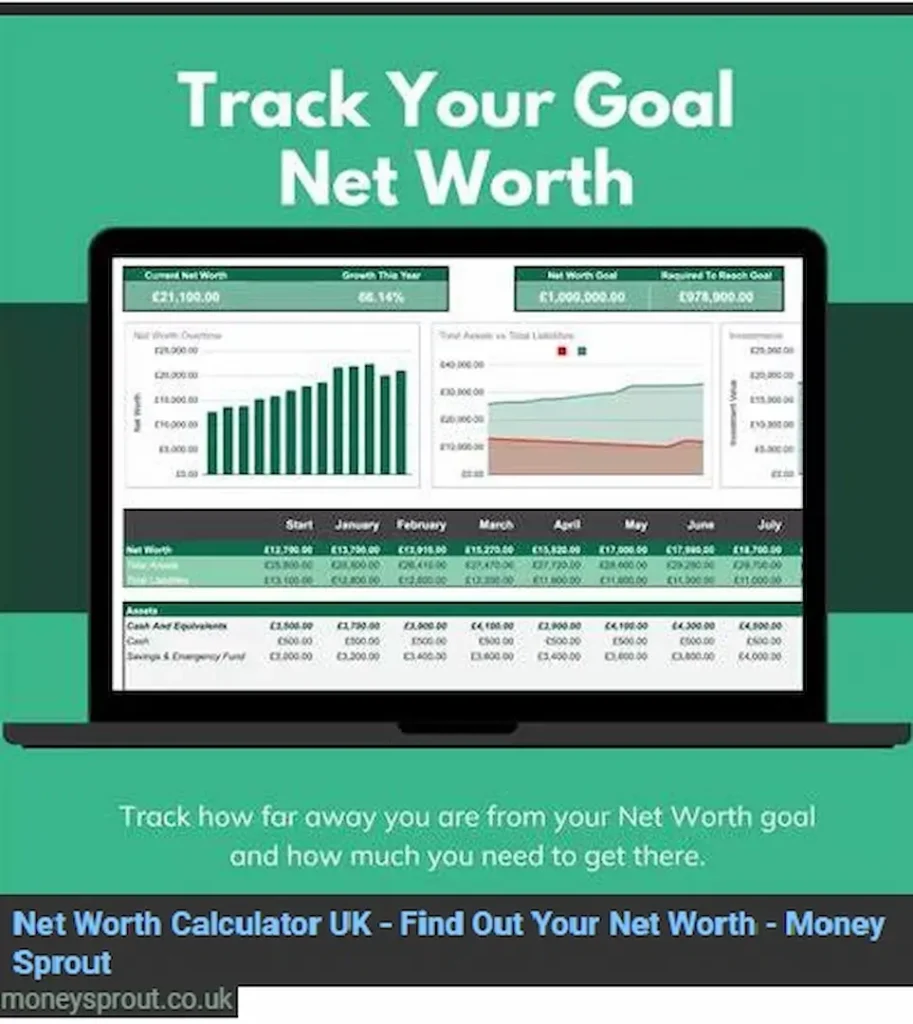

8. Track Your Net Worth Regularly

Your net worth is the total value of your assets (savings, investments, property) minus your liabilities (debts). Regularly tracking your net worth helps you see the bigger picture of your financial progress.

How to Track Net Worth:

- List your assets: savings, investments, real estate, and valuable items.

- List your liabilities: mortgages, student loans, credit card balances, and car loans.

- Review your net worth quarterly or annually to assess your progress.

Tracking your net worth can motivate you to improve your overall financial health.

Conclusion: Take Control of Your Financial Future

Achieving financial success isn’t about earning more money; it’s about making smarter decisions with what you have. By following these budgeting tips, paying off debt, automating savings, and investing wisely, you can build a strong foundation for long-term financial stability.

Call to Action: If you found these tips helpful, subscribe to our newsletter for more personal finance advice. In the comments, let us know which budgeting or investing tip you’ll start using today!

Our Expertise Sets Us Apart

Vivid Media Solutions: Unlocking the Power of Digital Media for Your Brand.

Engaging and Innovative Video Solutions

Engaging videos that bring your brand to life with stunning visuals.

Engaging Social Media Content

Engaging social media content that drives real results for your brand.

Promote Your Brand

Maximize your brand’s online presence with our expert digital media solutions.

Innovative Graphic Designs

Innovative graphic designs that capture attention and reflect your brand.

Comments are closed.